Angel Investors

How to Secure Early-Stage Startup Capital and Strategic Mentorship

The Real Role of Angel Investors in Startup Growth

Securing early-stage capital can make or break your startup. When venture capital feels out of reach and traditional loans are too rigid, angel investors often step in. These individuals provide critical pre-seed or seed-stage funding—often when all you have is a prototype, pitch deck, and a big vision. But angel investors bring more than capital. They offer mentorship, strategic connections, and long-term belief in your success.

What Is an Angel Investor, Really?

Angel investors use their personal funds to invest in startups, usually in exchange for equity or convertible debt. They often come in at the pre-revenue or early traction stage—before institutional capital is available. Check sizes can range from $10K to $500K+ depending on the investor and deal.

In some cases, angel investors are your first external backers, helping you transition from idea to product-market fit. Their decision to invest is typically based on three core factors:

Team conviction

Market potential

Early signals of traction

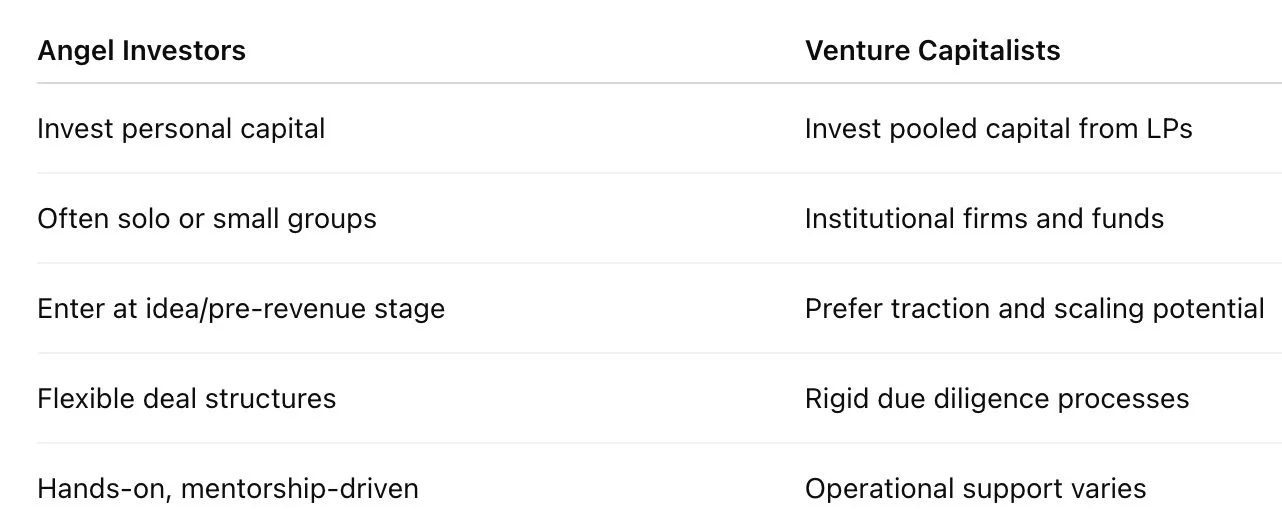

Angel Investors vs. VCs: Timing, Risk, and Relationship

Understanding the distinction between angel funding and venture capital is crucial for founders navigating the fundraising landscape.

If your startup is still in product development or building MVPs, angels are more likely to be the right fit. VCs usually follow once repeatable revenue or user growth is in motion.

Who Typically Becomes an Angel Investor?

Most angel investors are:

Ex-founders or exited entrepreneurs who want to stay close to innovation.

High-net-worth professionals with domain expertise.

Corporate executives looking to diversify their wealth and mentor rising startups.

Many are accredited investors per SEC guidelines, but some participate via platforms or syndicates without meeting those thresholds. Their goals can include capital appreciation, founder mentorship, or even early access to strategic innovation within their industries.

Angel Syndicates: Pooling Capital, Sharing Risk

If you’re raising a round above $250K, you may encounter angel syndicates—groups of investors pooling capital for a single deal. Syndicates often operate through platforms like AngelList, Assure, or Flow Club, making it easier to close multiple checks with one lead investor.

Advantages of syndicates:

Faster capital assembly

One point of contact

Access to a broader advisory network

While syndicates are typically private and involve larger minimums, they differ from equity crowdfunding in that members are often seasoned investors with the capacity to support follow-on rounds or referrals.

How Does the Angel Investment Process Work?

Here’s a simplified look at how early-stage angel investing typically unfolds:

Initial Pitch or Warm Intro – Often via founder networks or demo days.

Quick Due Diligence – Investors look at team, traction, TAM, and roadmap.

Term Sheet Negotiation – Typically SAFEs or convertible notes, sometimes priced rounds.

Capital Deployment – Funds are wired, and cap table updated.

Post-Investment Engagement – Regular updates, occasional strategic support.

Some angels invest via LLCs or trusts for tax efficiency and liability protection—particularly relevant for multi-deal portfolios.

Why Angel Investors Matter in Today’s Startup Ecosystem

In a climate where VCs are cautious and funding timelines are longer, angel capital bridges the gap. Angels help founders:

Build MVPs

Validate go-to-market hypotheses

Hire key early team members

Gain credibility for future rounds

Even in downturns, angel investors continue deploying capital—often backing high-conviction, high-upside opportunities others overlook.

How to Attract Angel Investors: Founder Playbook

If you're serious about closing your angel round, here’s how to position your startup:

✅ Build a Narrative That Resonates

Angels invest in people. Share your founder story, conviction, and what drives your vision. Authenticity > polish.

✅ Showcase Traction, Not Just Talk

Even small wins—loyal users, pilots, or signed LOIs—signal momentum. Angels want early proof points.

✅ Use Warm Intros

Most angel deals come from referrals. Tap into accelerators, alumni groups, portfolio founder networks, and syndicate leads.

✅ Highlight the Upside (and Risks)

Be clear about the TAM, path to Series A, and your competitive edge—but acknowledge what’s unproven.

✅ Position the Investment as a Strategic Opportunity

What can the investor gain beyond equity? Consider advisory shares, customer intros, or ecosystem alignment.

✅ Ask for Guidance, Not Just Money

High-quality angels want to help. Make space for their input—it increases engagement and long-term support.

New Trends in Angel Investing You Should Know

Micro-SPVs: Small special purpose vehicles allow multiple angels to invest in one deal without crowding the cap table.

Rolling Funds: Some angels now operate semi-institutionally via rolling funds with quarterly deployment schedules.

Thematic Angels: Many now focus on niche sectors like climate, AI, creator economy, or digital health—tailor your pitch accordingly.

Final Takeaway

Angel investors aren’t just check writers—they’re early believers, advisors, and often your first real validation. For founders, tapping into angel capital isn’t just about money—it’s about momentum.

If you're looking to raise your first round, develop a founder-led fundraising strategy that focuses on relationships, storytelling, and proof of execution. And remember: not all angels are the same—find those who align with your vision, values, and long-term roadmap.

Need More Support to Grow Your Startup?

If you're serious about building and scaling your startup, Pegasus Angel Accelerator offers programs designed to help early-stage founders move faster—with expert mentorship, hands-on resources, and direct connections to investors.

Whether you're launching your first venture or looking to grow an existing company, we have the tools and network to help you level up.

Disclaimer:

This article is for informational purposes only and does not constitute legal, financial, or tax advice. Always consult with a qualified attorney, accountant, or professional advisor before making decisions about incorporating your business, structuring your company, or engaging in fundraising activities.