409A Valuation

The Essential Guide for Private Companies Looking to Issue Equity

A 409A valuation is not just a regulatory requirement-it’s a strategic tool for private companies aiming to attract and retain top talent through stock options, stay compliant with IRS rules, and maximize exit value. If your business is preparing to issue equity or gearing up for a liquidity event, understanding and acting on your 409A valuation needs can directly impact your company’s financial health and employee satisfaction.

What Is a 409A Valuation and Why Does It Matter for Your Business?

A 409A valuation is an independent, third-party appraisal of your company’s fair market value (FMV). This FMV sets the strike price for stock options granted to employees, founders, and advisors. Setting the right strike price is critical: get it wrong, and your team could face hefty IRS penalties or lose out on equity value.

When Should You Order a 409A Valuation?

Timing is everything when it comes to 409A valuations. You need a fresh, audit-ready 409A in these scenarios:

Before issuing your first common stock options-this is non-negotiable if you want to avoid tax risk for your team.

Prior to any major liquidity event, such as an IPO, merger, or acquisition, to ensure your equity grants remain compliant and defensible.

After any material event that could affect your company’s value, such as a new funding round, major customer win or loss, significant partnership, or regulatory change.

A 409A valuation is valid for up to 12 months or until the next material event. If your company is growing rapidly or closing new funding, you may need to update your valuation more frequently to stay compliant and competitive.

Transactional Triggers That Demand a 409A Valuation

If you’re preparing for any of the following, it’s time to request a 409A valuation:

Launching or expanding your employee stock option plan (ESOP)

Closing a new funding round or convertible note

Negotiating a merger, acquisition, or sale

Onboarding key executives with equity-based compensation

Planning for an IPO or secondary sale

How to Select a 409A Valuation Provider That Protects Your Business

Not all valuation firms are created equal. To secure IRS safe harbor and minimize audit risk, choose a provider with:

Proven experience in business valuations, investment banking, or private equity

A track record of valuing companies similar to yours

Mastery of accepted valuation methodologies (market, income, and asset approaches)

Comprehensive, audit-ready reports that stand up to scrutiny.

What Information Do You Need to Prepare for a 409A Valuation?

To accelerate your valuation and avoid delays, prepare these documents:

Company details: CEO, legal counsel, articles of incorporation

Industry benchmarks: Comparable public companies

Financials: Historical and projected revenue, EBITDA, cash burn, and runway

Fundraising history: Recent and planned liquidity events

Cap table and option pool details

A robust data package ensures your valuation provider can deliver a precise FMV that supports your equity grants and withstands due diligence.

Key 409A Valuation Methodologies

Valuation experts typically use one or more of these approaches:

Market Approach: Compares your company to similar public companies, adjusting for differences in stock class and business stage.

Income Approach: Projects future cash flows and discounts them for risk-ideal for companies with predictable revenue.

Asset Approach: Calculates net asset value, often used for early-stage startups with limited revenue.

The right methodology depends on your company’s financial profile, funding history, and proximity to a liquidity event

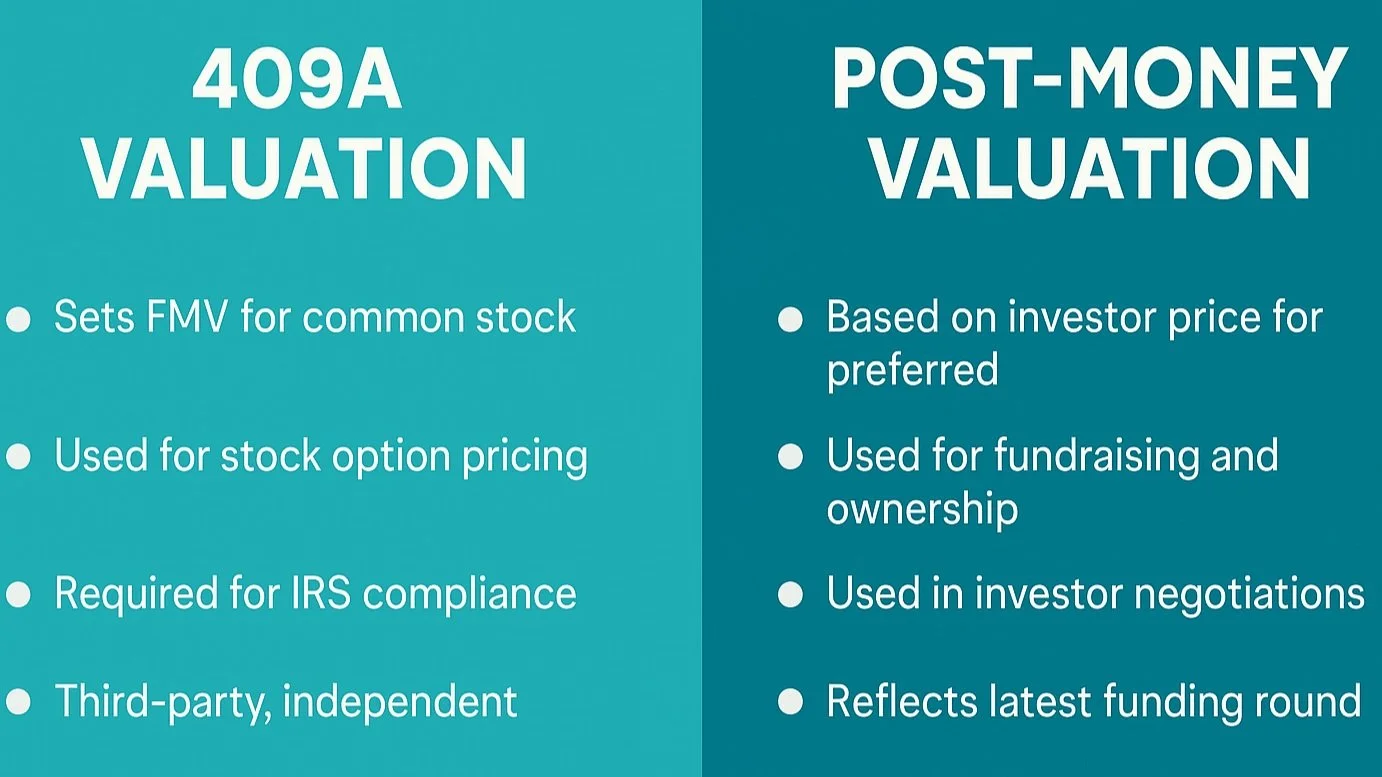

409A Valuation vs. Post-Money Valuation: Know the Difference

A 409A valuation is what the IRS cares about for stock option pricing and compliance. A post-money valuation is what investors use to negotiate ownership and future rounds.

Why Fast, Accurate 409A Valuations Are a Competitive Advantage

In today’s market, speed and accuracy in your 409A valuation process can help you:

Issue stock options quickly to close top talent

Stay compliant and avoid costly IRS penalties

Respond rapidly to funding rounds and acquisition offers

Present a defensible valuation in due diligence and audits

Ready to Order Your 409A Valuation?

If you’re preparing to issue equity, close a funding round, or plan for an exit, don’t wait. Secure your 409A valuation from a trusted provider to protect your company, your employees, and your future growth.

Why 409A Valuations Should Be a Core Part of Your Transactional Strategy

Many founders treat 409A valuations as a compliance checkbox. In reality, they are a powerful lever in your transactional toolkit. A defensible, up-to-date 409A valuation not only keeps you IRS-compliant but also positions your company to:

Attract and retain talent with competitive, tax-efficient stock options

Move quickly on acquisitions or secondary sales without valuation disputes

Negotiate with investors from a position of clarity and confidence

By integrating 409A valuations into your transactional planning-alongside cap table management, fundraising, and M&A strategy-you turn a regulatory requirement into a source of strategic advantage.

Take Action Now: Request Your 409A Valuation and Unlock the Full Value of Your Equity

Don’t let outdated valuations or compliance gaps slow down your growth. Request a 409A valuation today to set the stage for seamless equity grants, successful funding, and a high-value exit.

Need More Support to Grow Your Startup?

If you're serious about building and scaling your startup, Pegasus Angel Accelerator offers programs designed to help early-stage founders move faster—with expert mentorship, hands-on resources, and direct connections to investors.

Whether you're launching your first venture or looking to grow an existing company, we have the tools and network to help you level up.

Disclaimer:

This article is for informational purposes only and does not constitute legal, financial, or tax advice. Always consult with a qualified attorney, accountant, or professional advisor before making decisions about incorporating your business, structuring your company, or engaging in fundraising activities.